- BlankFi Believers Newsletter

- Posts

- BlankFi Believers Newsletter! Issue 3

BlankFi Believers Newsletter! Issue 3

www.BlankFi.com

📰 BlankFi Believers | November 2025

Editor's Note

Welcome to a new quarter in the dynamic world of Banking and Financial Intelligence! This edition is packed with insights, updates, and stories designed to keep you informed and engaged on BlankFi.

We are always working on new ways to engage our audience!

Check out the new BlankFi Brand Video!

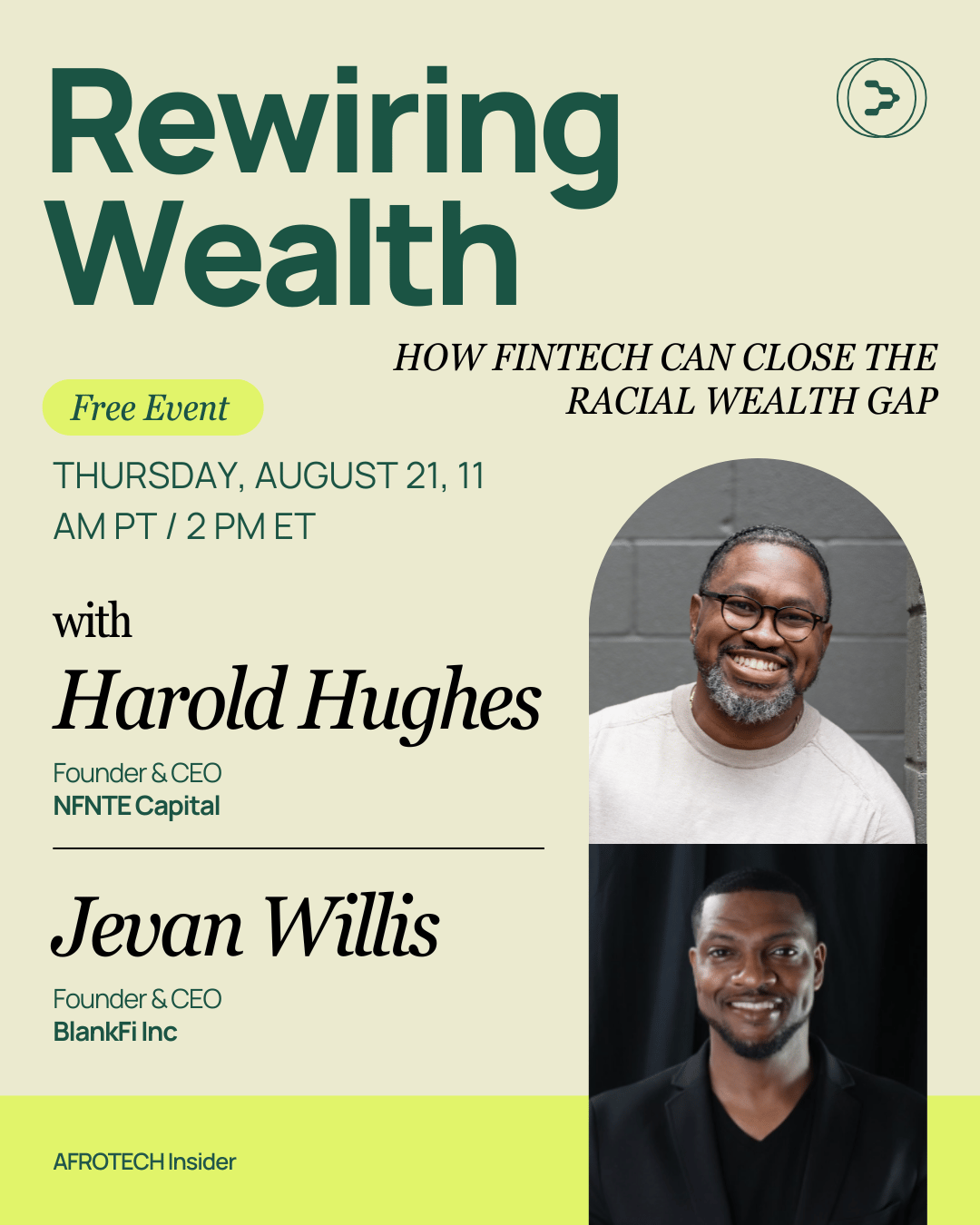

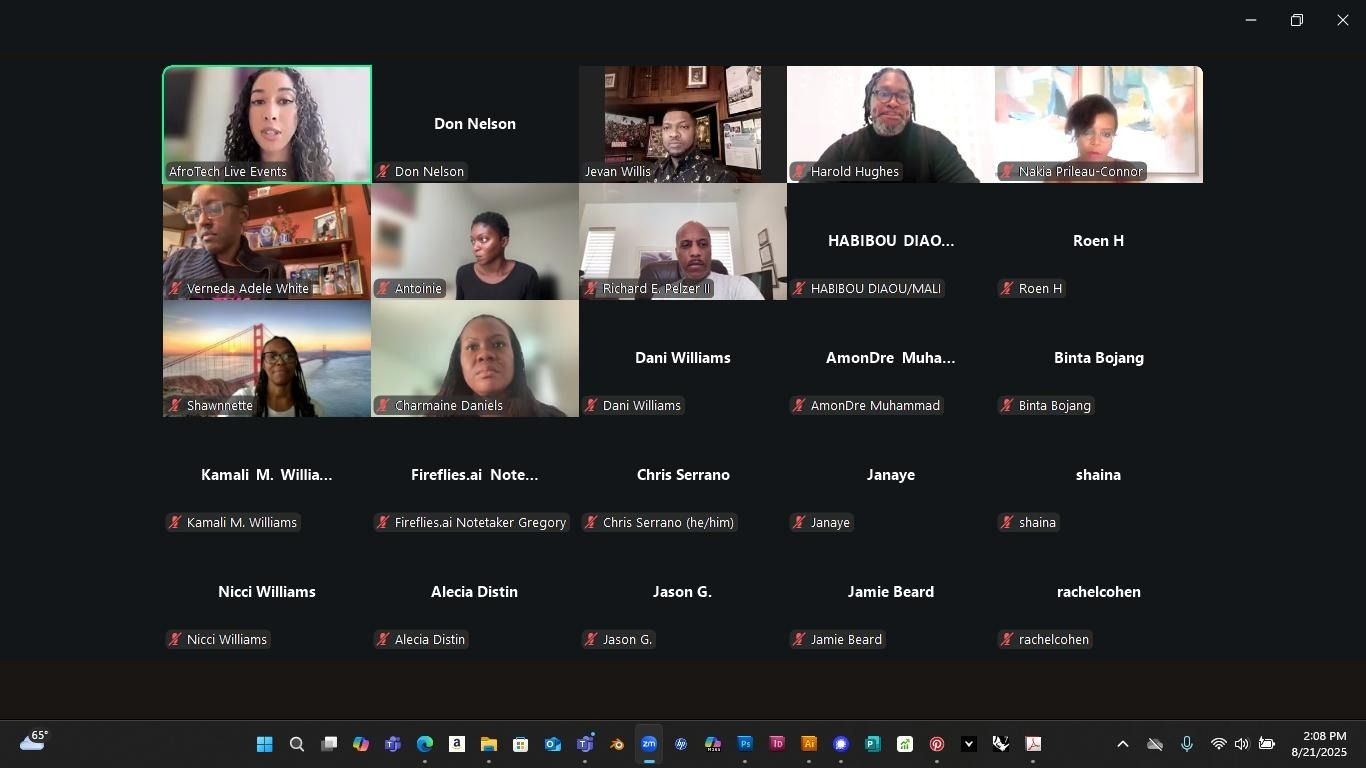

BlankFi’s Founder & CEO Jevan Willis was a guest panelist on the AFROTECH Insider’s panel discussing how to close the racial wealth gap and unlocking equity using Fintech pathways to capital and generational wealth.

AFROTECH Insider’s Ashlee Wakefield hosted a powerful virtual panel discussing how Fintech can help close the racial wealth gap with almost 200 people viewing in attendance. Founder & CEO of BlankFi, Jevan Willis expressed the importance of human capital over high cost purchases and luxury liability services.

Harold Hughes, Founder of NFNTE Capital said, “We need to normalize talking about money in our community. Sharing knowledge with friends, family, and networks helps break stigma and allows us to leverage the resources we already have.” Jevan explained the importance of enduring assets that grow in value, through relationships, knowledge and skills that create a lasting impact. Jevan also shared how leveraging Fintech and AI ethical banking tools can help people align their spending with their values and personal goals. This allows them to shift their mindsets and behaviors to make more intentional financial decisions that support ownership and long-term security for themselves and future generations.

The panel provided the viewers a front row seat to the insights, stories, and shared expertise both Jevan and Harold have experienced in their careers throughout the Fintech industry.

Events like these remind us of the power of collaboration and the importance of communication around how we use innovation, social and human capital, as well as the community through Fintech which can inspire action and help to close the racial wealth gap.

Thank you to AFROTECH Insider, Ashlee Wakefield, and Howard Hughes for such an engaging panel discussion.

BlankFi is offering you a chance to win big this holiday season!

Enter for your chance to win a $50 Visa Gift Card!

Fill out the Blankfi Survey or go to www.blankfi.com and click the link to the survey to get started. Contest last from November 18, 2025 - December 4, 2025.

Check out some of our previous winners!

What’s the word on the street?

🚨 THE GOVERNMENT SHUTDOWN HIT HARD — HERE’S WHAT WENT DOWN

When the government shutdown… everything else kept moving. Bills still came. Groceries still needed buying. Families still needed support. But hundreds of thousands of federal workers and contractors didn’t get paid. Some were told to stay home. Others were forced to work without pay.

And the people hit hardest?

👉 Low-income families

👉 Single parents

👉 Government contractors

👉 Communities already fighting to stay afloat

While Washington argued, everyday people struggled.

But they also got creative. And powerful. And united. Just like our community always does.

💥 HOW REAL PEOPLE SURVIVED (AND FOUGHT BACK)

🛠 Side Hustle Season

Air traffic controllers took second jobs. Federal employees turned to delivery apps, rideshare, online tutoring, temp gigs — anything to keep the lights on.

🍲 Food Banks Became Lifelines

With SNAP benefits delayed for many families, lines grew long but community support grew stronger. Neighbors helped neighbors.

📞 Negotiation Mode Activated

Utilities, landlords, lenders — people started calling before bills were late. And guess what? Many offered extensions.

💳 Smart Money Moves

People dipped into emergency funds, switched to cash-only budgets, froze subscriptions, and cut non-essentials.

💬 Community Carried Us

Support groups formed. Online forums lit up. Churches, nonprofits, local governments stepped up.

When the paychecks stopped — the people didn’t.

🌪 SO… WHAT’S THE REAL IMPACT?

Missed or delayed paychecks made families choose between food and rent.

Government programs slowed — everything from WIC to housing assistance.

Contractors may never get backpay.

Local economies lost millions because when workers don’t get paid, they don’t spend.

Mental stress skyrocketed — especially among single parents and lower-income households.

Shutdowns hit everyone, but they hit underbanked communities hardest — the very people who already face predatory fees, payday lenders, and expensive check-cashing traps.

⚡ HOW TO PLAN FOR THE NEXT SHUTDOWN

Yes, there will be another one. So let’s armor up.

1️⃣ Build a Freedom Fund (Even $10 a Week Works)

We’re not talking “finance bro advice.”

We’re talking:

$10 here

$20 there

Tax refund savings

Side hustle income scraps

It adds up.

A small emergency stash can stop predatory lenders from eating you alive.

2️⃣ Make a “Shutdown Budget Mode”

Before the next crisis hits, list:

Essential bills

Bills you can pause

Subscriptions you’d kill immediately

People you’d negotiate with first

This becomes your emergency switch plan.

3️⃣ Know Your Benefits & Rights

Most federal workers get backpay.

Contractors usually don’t.

Programs like SNAP or WIC may slow.

Knowing the rules lets you plan powerfully.

4️⃣ Stack Backup Income Options

Don’t wait until you’re desperate — now is the time to set up:

A gig-app account (even unused until needed)

A freelance profile

A sell-what-you-make shop (digital or physical)

A part-time skill you can turn on quickly

Think of it as your income generator button.

5️⃣ Move Your Money to a Bank Built for You

BlankFi is built for the underserved (coming soon 👀 !)

No predatory fees

Early pay access*

Emergency cash access features

Shutdown-mode financial tools

We’re building financial armor for households Congress forgets.

🎯 BlankFi TAKEAWAY

Shutdowns aren’t just political drama.

They are economic earthquakes.

But with the right tools, planning, and solidarity, our community doesn’t have to crumble — we can rise stronger each time.

BlankFi is here to make sure you’re not left behind, unheard, or unprotected.

🌟 We're Here for You

BlankFi is committed to helping you navigate these changes. We offer accessible, community-centered financial tools and education. Stay tuned for our upcoming events, webinars, and resources tailored to your needs.